🧑💼 Simplify Your Retirement Planning with the 401k Calculator

Planning for retirement can be overwhelming, especially with all the options and strategies available. One of the best ways to understand how much you need to save for retirement is by using a 401k Calculator. This simple tool helps you estimate the future value of your 401k contributions, factoring in things like your current savings, employer match, and investment growth. Whether you’re just starting your career or nearing retirement age, a 401k Calculator is a powerful tool to take control of your financial future.

📊 What is a 401k Calculator?

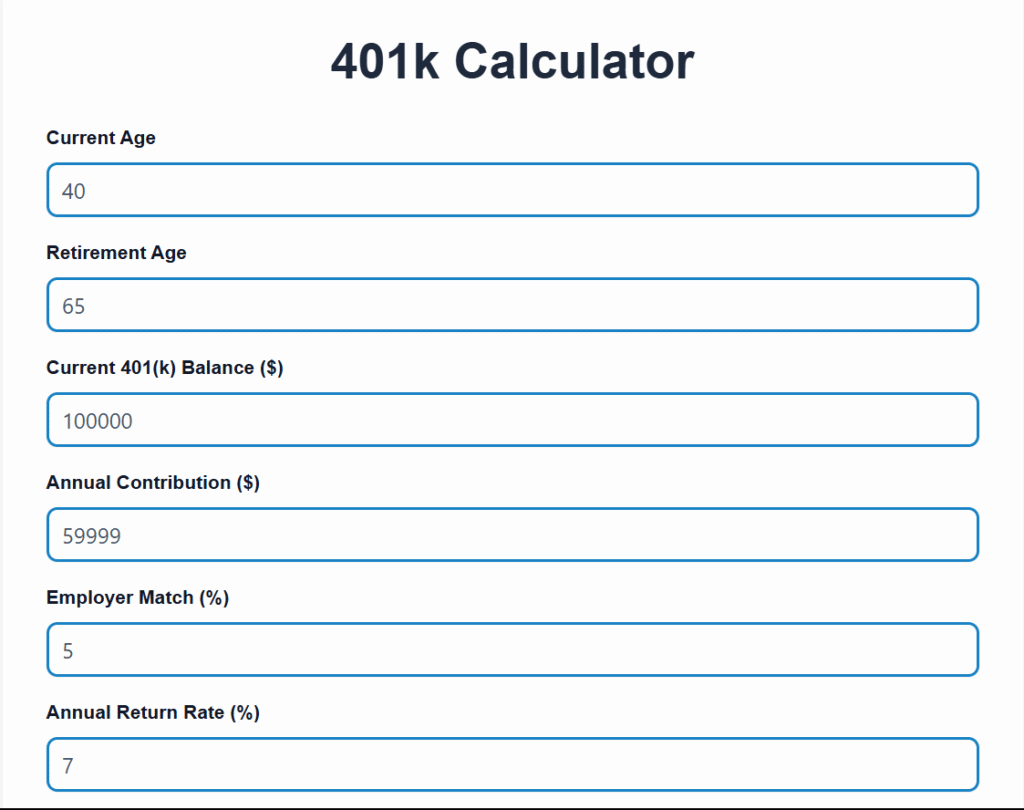

A 401k Calculator is an online tool that allows individuals to estimate how much they can accumulate in their 401k retirement plan by the time they retire. It takes into account variables such as:

- Current 401k balance: The amount of money you’ve already saved in your 401k.

- Annual contribution: How much money you plan to contribute each year, including both your contributions and employer match.

- Employer match: The percentage or amount your employer contributes to your 401k.

- Investment growth rate: The estimated annual rate of return on your 401k investments.

- Time to retirement: The number of years you have left until retirement.

By inputting these figures into a 401k Calculator, you can see how much you might have saved by retirement and how your contributions, growth, and employer match play a crucial role in reaching your retirement goals.

📈 Why Use a 401k Calculator?

Using a 401k Calculator helps you gain a clear understanding of whether you’re on track to meet your retirement goals. Here are several benefits of using this tool:

1. Estimate Future Savings

A 401k Calculator provides an estimate of how much you’ll have in your account by the time you retire. This helps you determine if your current contributions are sufficient, or if you need to adjust your savings plan.

2. Set Realistic Retirement Goals

By calculating the future value of your 401k, you can set more realistic retirement goals. You can see how small changes in your contribution, employer match, or investment growth rate can make a significant impact on your overall retirement savings.

3. Account for Employer Match

If your employer offers a 401k match, it’s crucial to take full advantage of this benefit. A 401k Calculator will help you understand how much your employer match contributes to your total savings and how to maximize this benefit.

4. Monitor Your Progress

Using a 401k Calculator regularly allows you to track your progress over time. By inputting updated figures, you can see how well your savings strategy is working and make adjustments if necessary.

💡 How to Use a 401k Calculator

Here’s how you can use a 401k Calculator effectively:

1. Enter Your Current Balance

Start by entering the current balance of your 401k. This is the money you’ve already saved and earned on interest.

2. Add Your Annual Contributions

Input how much money you plan to contribute annually. This will include your regular contributions as well as any employer match. Be sure to check the maximum contribution limit for 401k plans, which is $20,500 for individuals under 50 in 2022, with an additional $6,500 catch-up contribution if you’re 50 or older.

3. Set the Investment Growth Rate

The growth rate is an estimate of how much you expect your 401k investments to grow each year. Historically, the average annual return for stocks has been around 7%. However, you should tailor this rate based on your investment portfolio and risk tolerance.

4. Specify Your Time to Retirement

The next step is entering the number of years you have left until retirement. The longer you have to save, the more time your money has to grow through compound interest.

5. Review Your Results

After entering the necessary information, the 401k Calculator will give you an estimate of your total retirement savings. It may also provide visual graphs that show your projected account balance over time, helping you understand how contributions and growth accumulate.

💰 Tips to Maximize Your 401k Savings

While using the 401k Calculator is a great start, there are other strategies to ensure you’re getting the most out of your retirement plan. Here are a few tips:

1. Contribute the Maximum Amount

If possible, aim to contribute the maximum annual amount to your 401k. By taking full advantage of tax-deferred savings, you’re increasing your future financial security.

2. Take Advantage of Employer Matching

Many employers match your 401k contributions up to a certain percentage. Ensure that you’re contributing enough to get the full employer match. This is essentially “free money” and an important factor in maximizing your retirement savings.

3. Diversify Your Investments

To protect against market volatility, make sure your 401k investments are well-diversified. A balanced portfolio that includes a mix of stocks, bonds, and other assets can help you manage risk while aiming for growth.

4. Rebalance Periodically

It’s important to review and rebalance your 401k investments periodically. As you get closer to retirement, you may want to shift to more conservative investments to reduce risk.

🏁 Conclusion

The 401k Calculator is an essential tool for anyone looking to secure a comfortable retirement. It allows you to plan, set realistic goals, and monitor your progress, all while considering the factors that contribute to retirement savings—like employer match and investment growth.

By regularly using a 401k Calculator, you can ensure that your savings strategy aligns with your retirement aspirations. Whether you’re starting early in your career or nearing retirement, understanding your 401k and how much you need to save is key to achieving your financial goals.

Start using a 401k Calculator today and take the first step toward a secure and stress-free retirement!